Travel With Us

"Life is either a daring adventure or nothing at all."

The Of How Much Is A Real Estate License

These platforms offer sophisticated targeting to guarantee that your ads are shown to only the most pertinent and competent users, together with tools to help you build and track projects. When you have out of timeshare a few listings under your belt, you can start promoting your brokerage by means of open homes. While they may appear like an old-fashioned tactic, open houses are an excellent way for new brokerages to engage their neighborhoods.

What They Do: Property brokers and sales agents assist clients buy, offer, and rent properties. Workplace: Many real estate brokers and sales agents are self-employed. Although they frequently work irregular hours, many are able to set their own schedules. How to Turn into one: Every state needs realty brokers and representatives to be accredited.

Income: The average yearly wage genuine estate brokers is $59,720. The median yearly wage genuine estate sales representatives is $48,930. Task Outlook: Work of property brokers and sales agents is projected to grow 2 percent over the next ten years, slower than the average for all occupations.

Related Professions: Compare the task duties, education, job growth, and pay of property brokers and sales agents with similar professions. Following is everything you need to know about a profession as a realty broker or sales representative with lots of details. As an initial step, have a look at a few of the following tasks, which are genuine tasks with genuine companies.

The link will open in a new tab so that you can return to this page to continue checking out the career: - NAI Partners - Houston, TX Financial Investment Options - Most brokers enter into business to invest in realty; we motivate you to do simply that - either independently or with NAI Partners' own Investment Fund * Committed Support ...

You'll hunt for leads, cultivate relationships with ... - Savills North America - Houston, TX - how to take real estate photos... genuine estate broker. A lot of our effective experts introduced their professions as a broker student. Upon effective completion of our 15 months rotational program, you will transition to a complete time ... - The Curtis Johnson Group - Chandler, AZ Real Estate Sales Representative/ Listing or Buyer Expert Flexibility, way of life, and a proven system.

Some Known Facts About How To Become A Real Estate Agent In Ga.

- PADLAB - Scottsdale, AZ We are dedicated to delivering tailor-fit agent assistance. We understand what it requires to successfully execute a realty sale in today's market, and we make certain our highly-trained Real Estate Pros are ... - Coldwell Banker - Sacramento, CA Coldwell Banker NRT is seeking both new and skilled genuine estate agents who are looking to increase their profession up a notch.

Real estate brokers and sales representatives assist clients buy, sell, and rent residential or commercial properties. Although brokers and agents do comparable work, brokers are licensed to manage their own property companies. Sales agents should work with a realty broker. Property brokers and sales agents normally do the following: Get potential customers to buy, offer, and rent residential or commercial properties Encourage customers on prices, home mortgages, market conditions, and related information Compare homes to determine a competitive market cost Generate lists of properties for sale, consisting of details such as area and functions Promote homes through ads, open houses, and noting services Take potential purchasers Click to find out more or occupants to see properties Present purchase provides to sellers for consideration Moderate settlements in between buyer and seller Guarantee that all terms of purchase agreements are fulfilled Prepare documents, such as commitment agreements, purchase agreements, and deeds Because of the complexity of buying or offering a residential or commercial property, individuals typically seek help from genuine estate brokers and sales agents.

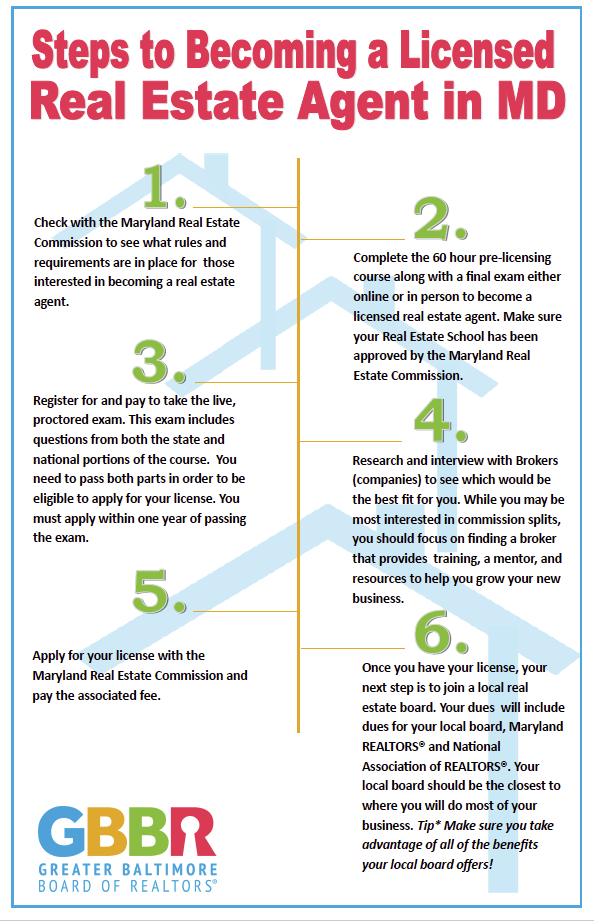

Others offer commercial residential or commercial property, and a little number sell commercial, agricultural, or other kinds of genuine estate. Brokers and representatives can represent either the purchaser or the seller in a transaction. Buyers' brokers and agents satisfy with customers to understand what they are trying to find in a home and just how much they can afford. Some States waive the experience requirements for the broker's license for applicants who have a bachelor's degree in property. State licenses normally must be renewed every 1 or 2 years; typically, no assessment is needed. However, lots of States require continuing education for license renewals. Potential representatives and brokers must get in touch with the genuine estate licensing commission of the State in which they wish to work to confirm the exact licensing requirements.

Brokers try to find representatives who have a pleasant personality and a cool appearance. They need to be at least 18 years old. Maturity, good judgment, trustworthiness, sincerity, and interest for the task are required to bring in potential customers in this extremely competitive field. Agents must be well organized, be information oriented, and have a good memory for names, deals with, and service details.

If you are a beginner to the industrial realty world, you might be trying to inform yourself with all of its vocabulary and principles before choosing whether you desire to dive into this particular profitable financial investment field. While you understand what a broker is, you may be questioning what do business realty brokers do? Here is some info so you can comprehend their function, and https://www.openlearning.com/u/millsaps-qg57d4/blog/GetThisReportAboutHowToBecomeRealEstateAgent/ whether they specialize in being a sales, purchaser, or leasing broker.

She or he has actually taken the requisite steps to become qualified to work in this field. When you use one of the brokers at Special Characteristics, you can be guaranteed that this expert has the required qualifications to work on such substantial transactions. Commercial property brokers make their license to work in this field by performing different steps.

The 4-Minute Rule for How To Make Money In Real Estate With No Money

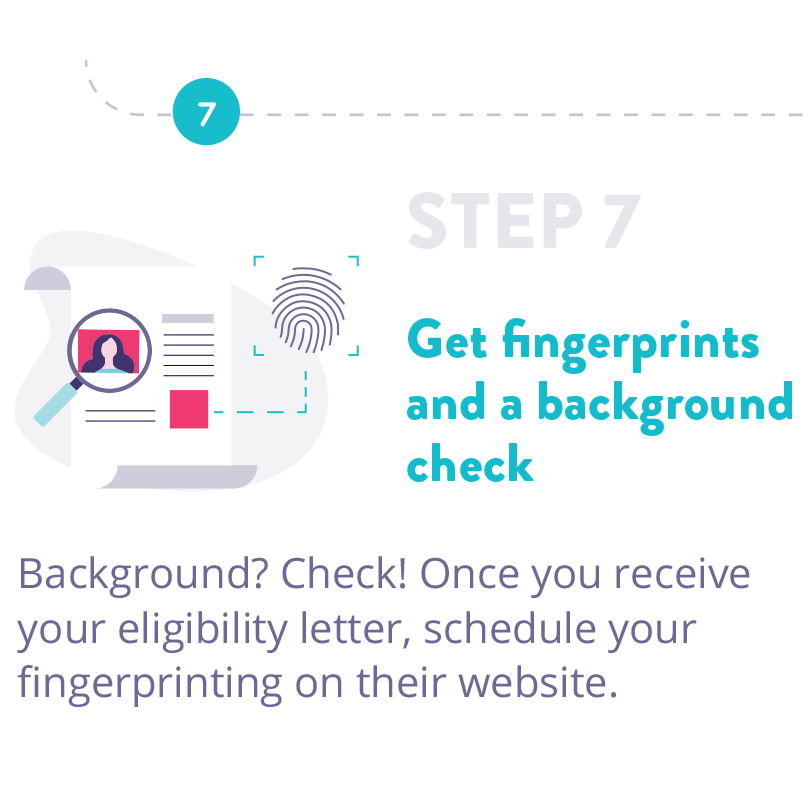

Then, he or she should pass both a qualifying background check and an examination to get a license, along with procure a mandated quantity of insurance coverage. And, throughout the course of their career, they must follow Colorado laws at all times with respect to their operations. If you are looking to acquire a residential or commercial property for financial investment functions, a broker is a clever choice to help you browse the progression of this offer.

An excellent broker also has comprehensive knowledge of the market in a specific location and must be able to offer recommendations on whether homes are positively priced. And sometimes, the broker learns of residential or commercial properties before they even go on the marketplace. Find out what concerns to ask before you buy business realty.

Fascination About How To Start Investing In Real Estate

If your financial investments aren't acquiring more than 2% a year in worth YOU'RE LOSING MONEY.Real estate investing has a natural hedge against inflation. Home naturally reacts in proportion to inflation. When inflation rises, leas and home costs also increase. The end outcome is that your financial investment is always in-step or ahead of the real-time market patterns and worths.

Another big perk property provides you is the capability to leverage funds. In property investing, you'll be able to put down a little percentage of the purchase priceor absolutely no dollars if you choose to wholesale, or use other individuals's cash, and leave with the investment completely.

Property is the only investment vehicle where you can put simply $20K down and own a piece of property worth $100K. Attempt purchasing $100K worth of stocks, bonds or gold for $20K. You'll get laughed right out of the bank (how to choose a real estate agent for selling). Many brand-new investor go with exit methods that need little to no capital, maximizing utilize to make their investing objectives an instant truth.

Each payment you make towards that loan assists you enhance your wealth and develop equity. Real estate has the distinct capability to develop substantial long-term capital. For lots of, this is the single-biggest factor to purchase realty. There's no limitation to your annual or ongoing returns. It's not uncommon for long-term property financial investments to return 15%, 20%, 30% or more annual.

The Main Principles Of What Is Blockbusting In Real Estate

Property investing has actually also ended up being central to many financiers' diversity strategies. Since the 2008 recession, stock market participation has experienced a double-digit dip, with simply half of Americans buying the stock market today. People lost big during the economic downturn, so now they're being smarter and more strategic about their investment portfolio.

Provided the significant differences and affects in property versus standard financial investments, it's simple to see how incorporating properties can protect your wealth in the brief and long-term. Generating property financial investments immediately diversifies and stabilizes your portfolio. By incorporating a variety of properties and investments, you're mitigating threat while setting yourself up for optimal returns.

Not only are there lucrative (legal) methods to mitigate losses, however there are apparently endless tax rewards, write-offs, advantages, and deferments. These consist of: As a real estate investor, it can feel like there's no limit to your welcomed write-offs. Tap a real estate-friendly accountant, consultant or accountant and they'll have the ability to guide you toward a variety of deduction chances, including some that might be market or exit strategy-specific.

That's devaluation. While everyone expects depreciation on a home, wear and tear result in needed repair or cosmetic upgrades (like paint, hardware, and tiles). As soon as sustained these costs can be subtracted. In the meantime, though, you can subtract devaluation utilizing the Customized Accelerated Expense Recovery System (MACRS). On a single house, for example, an investor can deduct devaluation for 27 years.

Not known Factual Statements About How Much Does It Cost To Get A Real Estate License

Even if you're making money on the home, you can still deduct for devaluation. Whenever you turn a home, you're generating capital gains. Capital gains are profits generated when a home or major investment is offered. Generally, these earnings are taxed as short-term capital gains or long-lasting capital gains depending on the length of time you held them.

If losses are greater than gains, you can likewise offset other income!While not as widely known, the 1031 Exchange is a great way to keep your genuine estate investing progressing while mitigating some of the large expenses. Under this tax code, financiers can "switch" one real estate asset for another, without paying taxes on the sale.

By now, you're most likely beginning to get a sense of the diverseand significantly lucrativeopportunities that exist under the realty investing umbrella. So the BIG concern: how do YOU earn money as an investor, now and in the future? There actually isn't a short answer to this question.

Your task is to take it all in and truly understand your goals, what's inspiring you and where you fit into this epic landscape. Here, we'll lay out,, and to assist you get a sense for how the market works and what makes good sense for you today sell your timeshare and tomorrow.

Facts About How To Get A Real Estate License In Texas Uncovered

While there are many methods to earn money as an investor, most of successful entrepreneurs focus on 3 key strategies: When you "wholesale" a home you find a "motivated seller," work out a lot, and get the home under contract. Then, instead of closing on the residential or commercial property, you find an end buyerusually a rehabber or landlordand sell them the agreement.

This cost can vary anywhere from $500 to $50K depending upon the regards to the offer. As a wholesaler you hardly ever take ownership of a property but, rather, earn money turning the agreement, not the home itself. There are a couple of different benefits of being a wholesaler. For something, you can generate income quite rapidly.

This technique is also beneficial if you have how to get out of a timeshare restricted capital or a low credit rating. Because you're not actually buying a house, no one's checking your credit or expecting 20% down. Nevertheless, similar to any other investment, wholesaling doesn't come without its threats. Earnings isn't an assurance and you constantly face the possibility that you'll have a hard time to find a buyer.

As a "rehabber," you're merely buying a financial investment home, making significant or small improvements, then offering it for a higher cost. A normal rehab deal (or "repair and turn") can take anywhere from a couple of weeks to several months, and in 2017, the typical rehab deal yielded gross earnings of $68K.

Get This Report on How To Be A Real Estate Investor

It provides you an chance to participate in physical labor before making a fast revenue. You also might take pleasure in the quantity of control you keep over the whole procedure of rehabbing a house. Nevertheless, anyone thinking about realty rehabbing need to understand that the expenses can accumulate pretty rapidly when you're repairing up a house.

As a "money flow investor" you're buying and then leasing out a home for https://blogfreely.net/lendaiktty/the-economy-in-san-diego-is-simply-too-strong ongoing money flow, either to a long-term occupant or short-term vacation tenants. The benefits here are obviousif you can discover occupants, you have a direct stream of month-to-month earnings. what is escheat in real estate. Plus, as with other realty investments, the value of your residential or commercial property is bound to increase in time.

You'll also supervise of finding occupants or occupants to ensure your residential or commercial property is filled year-round. Before digging too deep, it is very important to comprehend the varied that exist in the market. While strategic property niches can vary by location and market conditions, most investors tend to concentrate on one or more of the following types of properties: Single-family homes are the most common kind of home in a given marketplace.

The 5-Minute Rule for How To Generate Leads In Real Estate

Real-estate financial investment can be an intriguing and enjoyable method to diversify your properties. If you play your cards right and do your research, there's no telling how much money you can make through these financial investments. But you have to be cautious. Real-estate tends to be a very unstable market, and there are a great deal of threats that enter into it if you do not bear in mind particular components.

Realty financial investment trusts (" REITs") enable people to purchase massive, income-producing realty. A REIT is a company that owns and usually operates income-producing realty or associated assets. Visit website These may include office buildings, going shopping malls, homes, hotels, resorts, self-storage centers, warehouses, and home mortgages or loans. Unlike other realty companies, a REIT does not establish realty homes to resell them.

REITs supply a way for private investors to make a share of the earnings produced through business genuine estate ownership without in fact needing to go out and purchase business property. Many REITs are signed up with the SEC and are publicly traded on a stock exchange. These are referred to as openly traded REITs.

These are referred to as non- traded REITs (also called non-exchange traded REITs). This is one of the most important differences amongst the numerous kinds of REITs. Before purchasing a REIT, you ought to understand whether or not it is openly traded, and how this could impact the advantages and threats to you.

Additionally, some REITs might use higher dividend yields than some other investments. But there are some dangers, especially with non-exchange traded REITs. Due to the fact that they do not trade on a stock exchange, non-traded REITs involve unique risks: Non-traded REITs are illiquid investments. They usually can not be offered readily on the open market.

7 Simple Techniques For What Are Cc&rs In Real Estate

While the market price of an openly traded REIT is easily accessible, it can be challenging to figure out the value of a share of a non-traded REIT. Non-traded REITs typically do not supply a quote of their worth per share until 18 months after their offering closes. This may be years after you have made your investment.

Financiers may be drawn in to non-traded REITs by their reasonably high dividend yields compared to those of publicly traded REITs. Unlike openly traded REITs, nevertheless, non-traded REITs regularly pay circulations in excess of their funds from operations. To do so, they might utilize offering proceeds and loanings. This practice, which is typically not utilized by publicly traded REITs, minimizes the worth of the shares and the money offered to the business to acquire additional possessions.

This can cause possible conflicts of interests with investors. For example, the REIT may pay the external manager significant charges based upon the quantity of home acquisitions and possessions under management. These fee incentives may not always align with the interests of investors. You can purchase an openly traded REIT, which is listed on a major stock market, by buying shares through a broker.

You can likewise buy shares in a REIT mutual fund or REIT exchange-traded fund. Publicly traded REITs can be bought through a broker. Usually, you can buy the common stock, preferred stock, or debt security of a publicly traded REIT. Brokerage charges will apply. Non-traded REITs are typically sold by a broker or monetary consultant.

Sales commissions and in advance offering fees normally total around 9 to 10 percent of the investment. These expenses lower the worth of the financial investment by a substantial amount. A lot of REITS pay at least one hundred percent of their taxable earnings to their investors. The investors of a REIT are accountable for paying taxes on the dividends and any capital gains they get in connection with their financial investment in the REIT.

7 Easy Facts About How To Get A Real Estate License In Florida Described

Consider consulting your tax adviser prior to purchasing REITs. Watch out for any person who tries to sell REITs that are not signed up with the SEC. You can confirm the registration of both publicly traded and non-traded REITs through the SEC's EDGAR system. You can likewise use EDGAR to examine a REIT's yearly and quarterly reports in addition to any offering prospectus.

You must also examine out the broker or financial investment advisor who recommends acquiring a REIT. To find out how to do so, please check out Working with Brokers and Investment Advisers.

Genuine estate is normally a terrific financial investment choice. It can generate ongoing passive earnings and can be a good long-term investment if the worth increases in time. You may even use it as a part of your overall method to begin developing wealth. However, you require to make certain you are prepared to begin investing in realty.

Buying a house, apartment building, or piece of land can be pricey. That's not to mention the ongoing upkeep expenses you'll be accountable for, along with the potential for earnings spaces if you are in between occupants for a time. Here's what you require to learn about buying realty and if it's the ideal choice for you.

You need to consider this before you purchase a piece of investment property. If you can't pay for to pay cash for the house, at the extremely least, you should have the ability to Click for info pay for the home loan payments, even without rental earnings. Consider it: With tenants, there can be high turnover.

4 Simple Techniques For How To Become A Real Estate Developer

If you can't afford the home mortgage payment without the rental earnings, it might wind up being more of a monetary burden, instead https://gumroad.com/ceachenodg/p/the-main-principles-of-how-to-get-started-in-real-estate-investing of a means of building wealth. Plus, if you can't pay the mortgage, it could end up harmful your credit, which will cost you cash in the long run.

Often it is much easier to go through a rental business and have them manage things like repairs and rent collection. how to become a real estate agent in ny. While this will cost cash, it will assist relieve the problem of owning a rental property. Particularly if you do not have time to do whatever that needs to be done at your property, utilizing an agency is a great alternative.

In addition, you should take the very first few months of surplus money and set it aside to cover the cost of repairs on the residential or commercial property. It's also essential to have insurance coverage on the home (and plan for the expense). You should also be prepared to deal with additional costs and other situations as they occur, perhaps with a sinking fund for the home.

7 Simple Techniques For What Is The Difference Between A Real Estate Agent And A Broker

It's smart to get to understand some regional plumbing technicians, professionals, and carpenters in your area too. These are the professionals who know when a home is being gotten ready for the market. As pointed out, a contact who is a lawyer can absolutely be valuable when it familiarizes which homes are highly likely to hit the marketplace soon.

Probate homes are frequently more affordable than conventional residential or commercial properties due to the fact that they are being sold through a court-appointed representative as part of a will or in order to cover financial obligations. One of the simplest ways to discover probate properties is to simply go to your local court of probate and ask to talk to the person who handles probate matters.

You will have the ability to examine all open probate cases and contact the administrator or attorney dealing with the property directly. This will put you in the position to be the very first individual a possible seller speaks with. It is extremely possible that a determined executor may consent to offer a home to you directly in order to avoid fees or get around losing cash while a residential or commercial property sits on the marketplace.

6 Easy Facts About What Does Reo Mean In Real Estate Described

Direct mail provides a terrific how to get out of bluegreen timeshare contract method to extend your reach and let potential sellers know that you are a friendly face. Obviously, direct-mail advertising efforts need to be very targeted if you wish to prevent losing money (how to make money in real estate). The very best group to target could depend on the location where you're aiming to discover real estate offers.

Targeting house owners who are 65 or older would be a clever approach in this case. You have the option to send by mail a postcard, a printed letter or a written letter. Composed letters tend to have the greatest action rates. That's why sending them out to a choose group may be a wise technique for getting the greatest return on your investment.

Are you wondering how to find genuine estate financial investment offers for multi-tenant or rental residential or commercial properties? There's one angle that many people totally overlook. That angle is humanity. For instance, when landlords are tired of their duties and seeking to offer residential or commercial properties, that's your cue to swoop in and provide to make a deal.

Some Ideas on How To Become A Real Estate Broker In California You Should Know

Obviously, this might take more digging than other approaches. Expulsion records are generally available through the local court clerk - how long does it take to get real estate license. You might even have the ability to access the records online because they are public. That indicates that you can typically discover them using third-party sites. You can work your method backward using a home address if you're trying to get the contact details for the proprietor you desire to market to.

Some sellers just wish to discharge a home in as couple of actions as possible. These are the sellers that publish their homes on sites like Craigslist. In truth, numerous of the very best realty offers in United States can be scooped up online as soon as you find individuals who aspire to discharge their houses and move on.

You can save great deals of money and time by negotiating directly with a seller instead of handling a local property representative. People who will offer their houses frequently browse for packaging products, moving services, rental trucks, and associated things. You can market to individuals who remain in the early stages of planning a relocation utilizing keywords that aren't particularly associated to genuine estate.

Fascination About How To Get Started In Real Estate

You ought to also timeshare loan devote some of your budget plan for online advertisements to target people who lag on real estate tax. Lots of people who have fallen behind are simply months away from deciding to offer. There's likewise a huge opportunity to get your hands on prime properties as an outcome of divorce.

High lawn, dull siding, missing shingles, overgrown landscaping, and a driveway that remains in desperate need of repair are all indications that a house owner has actually inspected out. You ought to be driving around to hunt for homes that do not look very liked. You can frequently get some of the best offers on homes for sale by approaching owners who simply don't have the desire, interest, or capability to take care of their homes any longer.

Are property auctions a bargain? House auctions are not for everyone. However, they can supply excellent opportunities if you've done your research and you know what you're doing. The big perks of buying a property at auction are that you'll probably get a huge discount, and you'll most likely face a lot less competitors from other buyers.

Fascination About What Does Mls Stand For In Real Estate

However, the pool will likewise be more skilled. That might pose a challenge. There's likewise extra documentation and red tape to handle when purchasing a residential or commercial property at auction. You probably will not have the ability to have an evaluation conducted or be allowed to view the interior of the house in person.

You'll clearly need to be mindful when it pertains to rivals and stating too much. It's possible to network while still keeping your techniques near to the vest. It is likewise so essential to ensure you're not marketing to the incorrect individuals. There's absolutely nothing wrong with beginning with an extremely small, targeted audience when investing money in marketing efforts.

The reality is that people who don't require to offer their houses truly can't be persuaded. What you're really trying to do is provide a push to people who are currently motivated. You will likewise require to do your due diligence if you decide to pursue a foreclosure property. That suggests checking for any existing claims or liens.

Some Ideas on How To Buy Commercial Real Estate You Should Know

Do not let a failure to follow correct procedures cost you time, cash, and legal headaches down the roadway. It absolutely helps to go out there and actually take a look at what's going on in the market around you as you hunt for rock-bottom residential or commercial property offers. However, you can likewise cover a great deal of ground online, which will assist you with each point noted above.

The website for your regional county clerk's office is going to be your best resource for finding records concerning properties that will quickly be going on sale as a result of legal matters like inheritance, foreclosure, and more. You can then use a website like Yellowpages. com to access a people-finding tool that makes it possible to locate a homeowner's present address based on the information you get from county records.

This is when it will lastly be time to concentrate on raising capital genuine estate offers. You can do that by exploring LendingHome's swing loans for fixing and flipping. You can likewise enroll in a free genuine estate class that makes getting a bargain while purchasing a property without a realty agent a lot easier.

Little Known Facts About How To Become Real Estate Agent.

Begin today! The above is offered http://zionraed067.theburnward.com/7-easy-facts-about-how-to-get-your-real-estate-license-in-florida-shown informational purposes just and must not be considered tax, savings, financial, or legal suggestions. Please consult your tax consultant. All views and viewpoints revealed in this post are the author's own and not of LendingHome. All third parties noted on this page are for presentation purposes only and are not connected with LendingHome.

Excitement About How To Find Real Estate Deals

In many places, the proprietor pays the realty agent to assist find a desirable occupant. In more competitive rental markets, nevertheless, the renter might be accountable for the real estate agent cost, sometimes called a "broker fee (what is a cma in real estate)." These fees can be as low as $50 to $75 for a credit check or application, however more common rates are one month's lease or 15% of the annual rent on the house.

You can look for a range of property professionals in your area at realtor. com's Discover a Real estate agent database, that includes their sales efficiency, specialties, reviews, and other practical info. It's a great idea to speak to a minimum of 3 individuals face to face, and ask the representatives some key concerns to find out if they're an excellent suitable for you and the transaction you're searching for.

To comprehend what a genuine estate broker or REALTOR is, you initially require to learn about realty representatives. A genuine estate representative is a term that is commonly used to describe any licensed expert who assists individuals in purchasing, offering or leasing genuine estate. These genuine estate agents are more formally described as property salesmen in order to appropriately identify them from realty brokers.

The variety of hours of coursework that prospective real estate representatives must complete differs considerably by state from 75 hours in New york city to 40 hours in Michigan to 135 hours in California. After they have actually finished their training courses, property agents should pass a licensing test that is administered by their state.

Once genuine estate agents get their license, they must find a sponsoring broker or brokerage firm to work for. After doing so, all property representatives must take continuing education courses every number of years to maintain their licenses. Like property brokers and REALTOR, real estate agents are paid a commission for their service.

Not known Facts About How To Start In Real Estate

A typical commission is 6% of the purchase rate, however a specific realty agent normally walks away with only 1. 5%. The reason that the representative tends to win such a little cut is that the commission is http://kameronpjvy202.cavandoragh.org/how-how-to-become-a-real-estate-agent-in-pa-can-save-you-time-stress-and-money first split between the property expert representing the seller and the one representing the purchaser.

So, if you offer your home for $300,000, you might be paying $18,000 in commissions, but the realty representative you dealt with will just be receiving $4,500.

As a new genuine estate licensee, the primary step you'll need to do is pick a genuine estate broker. The procedure of picking a broker can begin early, as some states need that you be sponsored by a broker when you take your genuine estate test. Do not let the procedure of discovering a realty broker to work for daunt you.

How do you choose the best brokerage for your brand-new career? Evaluation the following 5 steps to discover how to select a realty broker. Many realty representatives get paid on commission. When you're not selling, you're not making money. how much does real estate agents make. However when you're offering, you're going to divide the proceeds with your broker.

( And some brokers offer employed positions, but these are scarce.) While factors like business culture, resources, market share, credibility, and support will also enter into play, you'll want to pick a brokerage that offers you a commission split you can live withkeeping in mind that commission divides often get much better with experience and sales volume.

Fascination About How To Start Real Estate Investing

That 6% is very first split in between the purchasing and selling agent. Now you're down to 3%, which exercises to be $9,000. Next, you're going to need to share that with your broker. If you're on a 60/40 commission split, you're taking home 60% of that $9,000, or $5,400. Naturally, this is before expenses and taxes.

Just make certain you comprehend the split and how you might get a larger percentage with time. Remember that some brokerages nowadays are using genuine estate agents a salary and advantages, or a hybrid design, so you might desire to look around if this technique to compensation appeals to you.

Are you looking for a little, mom-and-pop brokerage with an intimate, family-like brokerage culture? Or would you prefer a big-box franchise brokerage that's more likely to let you fend for yourself? Are you trying to find weekly parties and business caravans on open house day? The finest ways to know and comprehend a business's culture are legitimate timeshare resale companies to chat with agents who work there or go to a business function.

Prominent brokerage homes like RE/MAX or Keller Williams have workplaces all over the nation. A mom-and-pop brokerage may have been serving a single community for generations. Franchises tend to put in more control over their agents than an independent company, but they generally provide more how to end a timeshare presentation assistance and training. Independent companies are usually in your area based and consist of a little- to mid-size group.

The National Association of REALTORS reports that the majority of REALTORS (53%) select to work for independent companies. If you relish your independence and dislike corporate culture, an independent brokerage may be the method to go. The main benefits of a franchise are the many resources they offer in terms of information and marketing supportand the name acknowledgment.

The Of How Many Real Estate Agents In The Us

Search for "homes for sale in [neighborhood name] and see who comes up. You desire the brokerage you pick to have a strong market presence and a quality credibility. If they have a high market share, you can depend on them to assist you find leads. And we all understand how crucial a brokerage's credibility is.

Studies reveal that the ideal brokerage can triple your earnings. The ideal specific niche for you will probably be a mix of your interests, way of life and the chances offered in your area. Some brokerages are very hands-on and deal extensive mentoring, totally free training, and marketing collateral. Other brokerages are just positions to hang your hat while you get to work growing your own company.

You'll discover many variations in between the two extremes, and it's largely a matter of finding the business culture that you choose. When you're prepared to pick a real estate broker, keep these considerations in mind. Finding the right brokerage includes research study and interviewing. Do not be afraid to sit down with several property brokerages in your location to see who fits the very best with your learning style and business goals.

Why is broker choice so essential? In your very first year as a real estate representative, you'll have a lot of questions, uncertainties, and getting-your-feet-wet experiences. You'll require to pick a realty broker that will be there with you each action of the way. When you're very first beginning out, you won't have the funds to contend with the big property brokerages when it comes to marketing, list building, and conversion.

How Much Does Real Estate Agents Make Can Be Fun For Everyone

If you work with a brokerage that has a team-based approach, you will not have to stress over problems that might occur that would render your one point of contact not available for a period of time. timeshare meaning For example, a Door. com client just recently shared how the team approach worked for him.

The customer was rapidly linked with another representative, who examined the contract and made it the most attractive, which ultimately won the customer your house. Whether you're a newbie buyer trying to find a house in a particular rate variety or a long-lasting investor intending to make the most profit, you require somebody who's dealt with your sort of transaction prior to.

If you're looking for a selling agent, inspect out how they market homes by looking at their present listings. Are the homes attractively presented? Are they on the leading websites and on social networks? The online existence of your home is the most significant driver to getting it sold, so representatives who don't take this seriously are a waste of your time.

Do they follow the code of ethics? Do they interact effectively? Try to find information that is specific to your priorities. After all, you desire a representative who works for you and your goals, and past customers are an excellent method to figure out how your experience will be. When speaking with representatives, keep an eye out for the following warnings: - Pricing a house too expensive for the market will dissuade purchasers from taking a look at it since it will produce the impression that you're unrealistic.

- Simply since you know them doesn't imply they're going to do the finest job at offering your home or finding you listings. Selecting somebody you're close with may have a negative impact on both your property deal and your relationship. If you're still deciding in between numerous agents or brokerages after discovering all of the above, go with the one who asks you the best concerns.

And when it comes to client service, Door. com's experience is genuinely unrivaled. what does arv mean in real estate. Contact us today and learn for yourself.

The Facts About What Does A Real Estate Agent Do Revealed

So you're prepared to purchase a house. Fantastic! But how are you expected to pick a real estate representative, when half individuals you satisfied at the last networking event were in the business? They're everywhere! Just like a lot of decisions, you simply need to take some time and do some research.

Buyers agents will comb out of timeshare through Multiple Listing Solutions (MLS) to discover houses that satisfy your requirements. They'll set up provings, connect you with related services such as house inspectors, help in settlements and crafting an offer, and hold your hand as much as you need through the buying procedure. Property representatives earn a commission based upon a percentage of the selling cost.

The overall of in between 4 and 7 percent is typically divided in between the 2 agents. That suggests that the average home sale, around $300,000, will supply around $9,000 for each representative. Numerous purchasers do not recognize just just how much cash their representative will make. Thinking about the reward for your agent, it makes sense to take some time in choosing the person who will assist you find exactly what you desire at the best rate.

Before choosing which realty representatives to interview, determine exactly what you want in your brand-new home and where you wish to be situated. Also spend a long time searching on Google or Yelp for reviews of the agencies or agents you are most thinking about dealing with. When other people hear you're buying a house, you can anticipate to hear that everyone has an aunt or a cousin or a good friend who's a Real estate agent.

Search for recommendations of representatives they've really dealt with. Be careful using buddies as a representative; if problems develop, it can be harder to come to a resolution when you're likewise familiar on a personal level. Hold them to the exact same requirements as any other agent (And that professionalism goes both ways.

This is how they earn a living.) So how do you narrow the field down and pick the right one? The key is asking the best concerns to each candidate. How lots of other buyers are you presently working with? What techniques do you utilize to find new residential or commercial properties? What is your policy for handling numerous deals? Can you provide references from purchasers you've worked with in the past? What is involved in your purchaser's broker contract and is it special or non-exclusive? What type of assurance do you provide if I am unhappy with your representation? Do you work with other suppliers such as mortgage brokers, home loan insurance companies, or title business and if so, are you a paid affiliate? What portion do you charge? Will I be dealing with you solely or will I be working mainly with an assistant? Do you work part-time or full-time as a realty representative? What are your hours of availability and chosen approaches of contact? Is your license in great standing and have you ever had a complaint submitted against you? The number of years have you been a genuine estate agent and what type of continuing education do you attend each year? The number of short-sale or foreclosure transactions have you organized? Do you ever represent the purchaser and the seller? Not all of these will apply to your situation, so focus on the ones that make sense and provide you the information you require.

Some Ideas on How Much Do Real Estate Agents Charge You Should Know

Make the effort to vet them. The initial time financial investment will pay dividends throughout the home-buying procedure. Marisa is an award-winning marketing specialist who enjoys to write. Throughout the day, she wears her marketing hat in her marketing director function and at night she works as a freelance author, ghost writing for customers and contributing to publications such as Huffington Post and Social Network Today.

Last Updated: June 4, 2020 Finding a good realty agent can be a long, challenging procedure. Purchasing or offering a home is normally stressful, so it is worth it to to take the time to discover a representative who can smooth the way for you. Take a while to research study and conduct interviews prior to selecting.

Posted by: Kaplan Realty EducationUpdated: January 15, 2019The initial step to success in is making a good service decision. Part of ending up being a licensed realty salesperson is picking a broker to sponsor you. Although it holds true that you're technically working for yourself, a realty agent can not act as a property representative individually; they should work on behalf of a property broker.

Many realty companies are continuously recruiting salesmen. Nevertheless, there are big differences among business in structure, operation, and philosophy. Your goal is to discover the realty workplace that you like and will eventually be the ideal fit for you. If you have not https://b3.zcubes.com/v.aspx?mid=6618400&title=the-only-guide-for-what-do-real-estate-agents-make chosen your profession specialized or property brokerage, there are a number of elements to consider.

The 9-Second Trick For How To Become A Real Estate Agent In Oregon

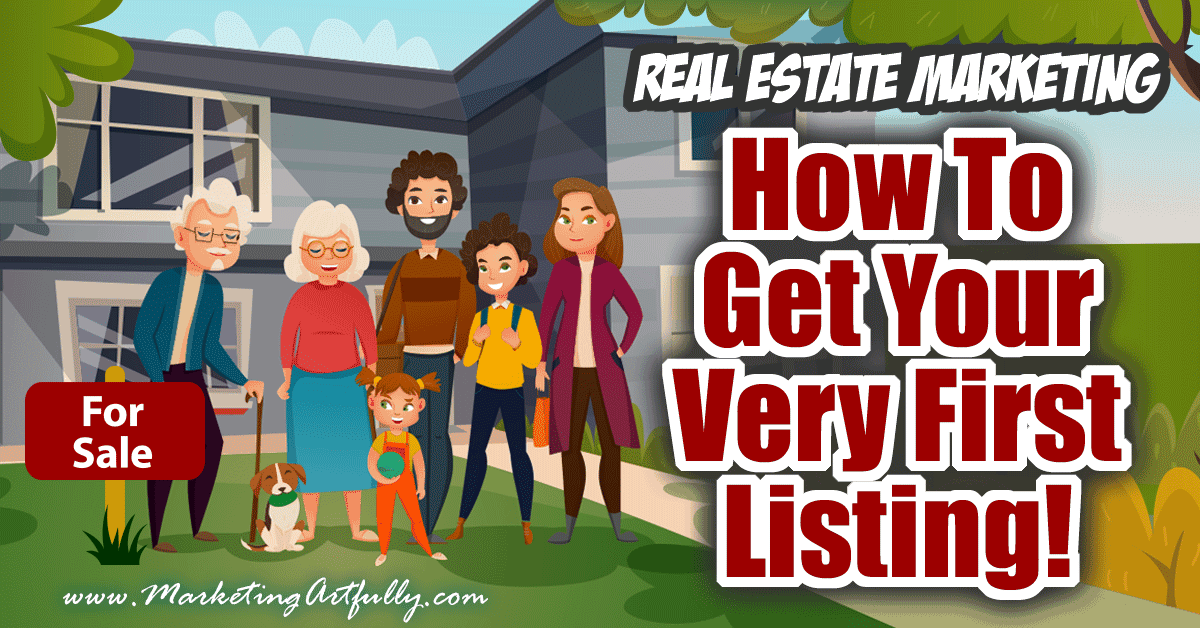

Come up with a tactical plan on how you will create exposure for the listing. If the strategy is excellent and prices is in line with expectations, you might well discover yourself representing the seller moving forward! Pro Suggestion: The very best time to contact expired listings is at the very start of the year.

Did you understand that you're able to look up keywords and locations in the search box at the top of your Facebook profile? Give it a try! If you key in your city along with a couple of keywords connected with selling a house things like packaging, home searching or moving you may very well discover people in your extended network who might qualify as seller leads - what percentage do real estate agents get.

Every Facebook 2. 41 billion monthly user becomes accessible through Facebook Ads and you can establish habits, demographics, and interests to active target customers in your local market. Facebook Ads resemble signboards of Facebook and are extremely powerful for driving traffic to your site, and in turn producing leads.

Once they become a lead in your CRM, our system will automatically follow up and nurture them up until they show hot behaviors. When they do, you get an alert letting you understand it's for you to call them. Do not worry, we'll keep track of each message, reply, saved listing, home search, and so on.

Throughout an open home, you'll come across newbie house buyers along with second-time home purchasers. These second-time home buyers are looking for a new house and looking to seller their present home. There aren't many opportunities to satisfy a lead for an in-person interview or consultation, but an open house encounter speeds up the process.

Ask about their house and if they're seeking to sell: about the functions, how far along the selling process they are, if they're going to stage, and other comparable subjects. You can offer a complimentary home assessment and anything other services you can offer through your network movers, cleaners, landscapers, and so on.

Which techniques work best for you? Let us understand in the comments. Editor's note: This blog was initially released in Might of 2017 by Jessica Schweppe and has actually been updated by Brian Lim for precision, brevity, and comprehensiveness. how to get real estate license in ga.

Some Known Questions About What Does Reo Mean In Real Estate.

A property list building company is a platform that assists agents attract potential customers (either purchasers or sellers), referred to as leads, to a certain firm or broker. A lead generation business will run advertisements and market to potential clients when they visit sites such as Google, Zillow, or Facebook and search for houses.

However, these companies do not ensure that these leads will close or that they will even react to you when you contact them. Genuine estate list building is a marketing and advertising procedure which stimulates interest in either a home for sale or a real estate agent to work with. This interest is then turned into a sales pipeline with the goal is to turn the lead into a customer, who then closes an offer by either purchasing or offering a house through an agent.

Leads are what keep a genuine estate brokerage in service. A closed lead offers a commission check to the representative and a check to the brokerage. Real estate list building business http://arthursmgo592.yousher.com/the-facts-about-where-to-invest-in-real-estate-uncovered use various prices depending upon the place and number of leads chosen. Some have onboarding fees of a couple of hundred dollars and others have no in advance costs but charge regular monthly costs of $199 or more, plus per lead costs which can range from $20 all the method up to the thousands of dollars.

Normally, you pay for leads monthly and can select a set budget or alter it up depending upon how service is going. Most representatives know that, in order to keep up with today's purchasers and sellers, they need to have an online presence. Purchasing online leads timeshare resale scams deserves it if you do not currently have a huge network or referrals however wish to grow your company.

Buying lead generation is only beneficial if you're going to be persistent and constant with following up on each and every lead. As part of this review, we took a look at over a dozen realty list get out of my timeshare building business prior to picking our top picks. We evaluated each company based upon the number and types of leads they provide and lead quality, in addition to functions, pricing, client reviews, and more before choosing our list of the finest lead-gen companies readily available.

Follow up like a manager using our realty lead management system! Wise Agent's Lead Management System has been turning lots of heads and getting a lot of attention as more realty representatives and workplaces understand how effective of a feature it has actually become. At the very same time, it stays very simple to establish and easy to utilize.

Wise Representative Lead Management System is personalized and makes it possible to split or A/B test. You are also able to set up various rules for various lead sources. Each lead from a particular lead source can introduce a special realty drip project created specifically for that source. The new leads can instantly be contributed to the daily Call List, which is another hit function we will discuss here.

Getting The How To Invest In Commercial Real Estate To Work

For circumstances, if you are targeting purchasers in a specific advertisement, all the leads produced from that ad can immediately be put under the category of "buyers". As quickly as a brand-new realty lead can be found in, you can have it set to fire off an instant e-mail that utilizes the lead's name and source in the e-mail.

E-mails and telephone call are still a should in today's lead conversion process, but the top method Wise Representative members have been using to convert more leads is the execution of our Wise Text function. Each brand-new lead can get an individualized SMS text message that uses the lead name and source name in the text.

The Buzz on What Do Real Estate Brokers Do

The 70 percent guideline quickly, efficientlyand roughly!screens a property to decide if it's worth more investigation. Never ever utilize a "general rule" to choose exactly how much to pay, or if you ought to invest or not. If a residential or commercial property passes the above rules (or gets close) it may be worth a more detailed analysis.

Wholesalers search for fantastic offers from motivated sellers, sign a "purchase and sale contract" with that seller, and then assign that deal to other financiers for a cost. That fee typically varies from $2,000 to $10,000, though it's dependent on the offer. In a manner, they resemble a property agent.

While agents do not typically work much with wholesalertypically they are trying to find residential or commercial properties to buy and sell without including an agentit's still a good idea to understand what a wholesaler is and how they work - what is escheat in real estate. You are most likely to work with a wholesaler when one desires to use on a house noted on the MLS, which does take place rather regularly.

As the name suggests, the buy and hold financier purchases residential or commercial property for the long run. Some search for stunning turnkey homes. Others want junky residential or commercial properties. A lot of, however, search for something in between. No matter their precise method, purchase and hold financiers all desire something: favorable capital. In the most easy terms, capital is the extra cash left in the investor's bank account after all the costs are paid, including those expenditures that do not begin a routine schedule, like maintenance and vacancy.

The smart Trick of How To Take Real Estate Photos That Nobody is Discussing

To calculate possible capital, simply subtract a property's overall costs its income potential. That may sound simple, but identifying "total costs" can get made complex. What about jobs? Expulsion costs? Legal charges? Upkeep costs?Here's an example. 123 Main Street is a single-family home listed for $100,000. Your investor customer plans to purchase the property with a 20 percent down paymentthat's an $80,000, 30-year home mortgage at 5 percent APR with a total mortgage payment of $429 (what is redlining in real estate).

Taxes are $1,200 annually, or $100 per month, and insurance coverage will be around $600 per year, or $50 monthly. The future renter will be responsible for all energies and other charges, so the total fixed expenditures come to $579. 46 monthly. If rent has to do with $800 each month, you 'd think capital need to fall at $220.

This is where the typical realty representatives stop and inform their clients about this great, money streaming offer. The picture changes when you analyze expenses more fully. For instance, if the investor prepares to work with a residential or commercial property manger, add another 12 percent every month in fees. In addition, account for 5 percent of the totally yearly income for job and 10 percent (or more) for maintenance expenses.

46: -$ 100: -$ 50: -$ 80: -$ 40: -$ 80: -$ 29. 46Notice how rapidly the when "incredible capital" deal disappeared? These numbers do not even include eviction expenses, significant repair work, such as a brand-new roofing or parking, or other unanticipated charges. At this moment, hopefully you determine the reasons behind that detach in between realty representatives and investors and comprehend what qualifies as a "bargain." Good financiers constantly run these numbers ahead of time.

How To Invest In Real Estate With No Money Can Be Fun For Anyone

For me? Never. Nevertheless, every financier is various, which is why it is essential to understand what your investor wants. Some investors will accept unfavorable cash circulation since they think that appreciationor the increase in house worths over timewill increase more than the loss they are taking on their monthly capital.

After all, remaining on the very same page is vital to developing a long lasting company relationship.: If you are handling a new investor, they may not have the responses to all these concerns. Numerous realty agents avoid rookie investors like the plague, because they squander everyone's time and wind up without any outcomes (what is the difference between a real estate agent and a broker).

Remember, however, that we all need to start someplace. Had my first representative not assisted me through my first offer, I would have been entirely lost. The following concerns should assist both you and your client learn what your client knowsand BiggerPockets can be your backup assistance team.

What's their hawaii timeshare exchange investing experience? Did they just leave a hype-filled weekend bootcamp where they were offered pie-in-the-sky dreams? Do they have a property, financing, or company background? Have they done their homeworkfrankly, do they even understand what they are discussing? Realty investing is more of a "organization" than you may believe.

How What Does Reo Mean In Real Estate can Save You Time, Stress, and Money.

Look for financiers who aren't scared to check out a business book and can continue a conversation about running an effective organization. This question should come early on. An investor without a plainly defined end goal often can't decide what sort of investing they desire to pursue. For example, if an investor's objective is to continue working however retire in 10 years from passive earnings, then flipping houses is probably not their perfect strategy.

By comprehending the big picture, you can anticipate the type of residential or commercial properties they might be interested in and the type of services they might seek. Do not hesitate to get personal if you feel comfy. What do they imagine doing 1Financing can be a discouraging part of dealing with investors.

Have you ever dealt with an investor, only to have a deal break down due to the fact that they couldn't line up the funding? It happens regularly because lots of financiers' eyes are just bigger than their checkbooks. Lots of investments need creativity to seal the deal. Others just need a simple bank loan with 20 percent downor even 100 percent cash.

Knowing the financier's specific strategy determines what other questions you ought to ask. It also offers a better understanding of what kind of services the investor may need. Next, the apparent question: "What are you looking for?" There are numerous various niches, from single household homes to multifamily to industrial. Then, each of those niches has many sub-niches.

The Ultimate Guide To What Is Cam In Real Estate

For example, presently I am pursuing small multifamily properties with in between 2 and four systems that can supply $200 per unit each month in positive money flow. Understanding the exact property specific niche and sub-niche is exceptionally important, so be https://storeboard.com/blogs/general/what-percentage-do-real-estate-agents-make-for-dummies/4601670 sure to narrow this down with your financier. Is the investor looking for multimillion dollar timeshare users group houses or small starter houses? A high- or a low-end multifamily? Within every niche and method there are several rate pointsso comprehending what your investor wishes to invest is valuable in deciding what to search for.

If your investor desires starter homes in the $100,000 variety that don't require much work, however the lowest price homes on your market are in the $300,000 variety, they might not have a strong grasp on what is available or may be searching in different areas than you presently serve.

Usually, the majority of investors are not searching in the fanciest parts of townthough some areand most aren't looking in rougher areasthough once again, some are. A lot of are looking for something in the middle. Ask your financier where they intend on buying or selling and what locations run out the running. It's an excellent idea to understand who your financier is dealing with.

The Only Guide for How Does A Real Estate Agent Get Paid

A Real estate agent will absorb the transaction's turmoil and make it as smooth as possible for their client. They leave the impression that their job is simple. Their immediate family knows how hard an agent works however. When a listing representative does the task correctly, their clients see the worth that they bring.

This goal is attained through a combination of impressive marketing and effective settlement methods. Yes, in the majority of states, a listing representative can represent both the buyer and the seller. This practice is called. Although an agent can lawfully represent both sides of the house sale, it's a hazardous process.

Here's an article covering the concerns that can arise when getting in into a double firm property transaction: This short article covers the most typical circumstances in which Realtors get paid. There are still plenty of https://www.wpgxfox28.com/story/43143561/wesley-financial-group-responds-to-legitimacy-accusations other specific niche subjects that we haven't covered, such as Flat-Fee, Part-Time, and Commercial Real estate agents. If you have particular concerns about different property situations, feel free to contact me.

I run my own genuine estate brokerage in Colorado Springs, and I delight in sharing my understanding with anybody who can take advantage of it.

October 20th, 2020 In a genuine estate deal, the representatives or brokers involved are normally paid by the seller through commission rather than a flat fee. Examine out our easy-to-use property commission calculator listed below to compute the commission rates for your deal, and discover more about how this quantity is calculated even more down the page.

For example, if a house owner offers their home for $200,000, and the commission rate is 5%, the formula would be (5/100) x 200,000 = $10,000 commission. It's crucial to keep in mind that commission is consisted of in the cost of sale, it's not an additional fee. In the example above, the seller would really only get $190,000 for the house, as the other https://southeast.newschannelnebraska.com/story/43143561/wesley-financial-group-responds-to-legitimacy-accusations $10,000 would instantly go toward a commission for the agents/brokers included.

See This Report about How To Get Into Commercial Real Estate

For example, a representative might charge an 8% commission for the very first $100,000 and 4% for the rest. To calculate this uneven rate, you can simply break it into 2 formulas and after that combine the outcomes to find the overall rate. (8/100) x 100,000 = $8,000 (4/100) x 100,000 = $4,000 8,000 + 4,000 = $12,000 total commission Determining the genuine estate representative commission split is really easy.

There are two approaches to set about calculating this split rate, which we'll demonstrate utilizing the example above: Take the total commission rate and divide it by 2 (5/100) x 200,000 = 10,000 10,000/ 2 = $5,000 commission for each agent Compute using half of the agreed-upon percentage 5/2 = 2.

5/100) x 200,000 = $5,000 commission for each agent To guarantee you're getting an excellent rate, it is essential to have a comprehensive understanding of your market and maintain to date on industry trends. The average realtor commission rate is normally in between 5% and 6%, however recent data shows that this number decreased over the past year due to the Coronavirus pandemic, landing at around 4.

According to Bankrate, this type of downtrend is normal for sluggish financial periods. During the property boom of 2005-2007, commission rates fell as many alternatives were available for buyers and sellers. Throughout the Great Recession that followed, commission rates actually returned up as sellers had fewer alternatives and were more happy to pay for the help of representatives and brokers.

continues to grapple with the pandemic and economic fallout. However, August 2020 information from the National Association of Realtors shows that house sales in fact increased by 24. 7% compared to July 2020, which is a year over year increase of 8. 7%. In fact, current data from Clever programs that property commission rates may already be bouncing back.

06% to 5. 85% in September 2020. It is necessary to note that these rates differ commonly by location, so check your localized market for more accurate details. Below are a few clarifying questions and responses to shed more light on how property commission works. A real estate agent's commission on a million-dollar house would be $30,000, assuming a typical 6% commission rate. how long to get real estate license.

The Only Guide to When You Have An Exclusive Contract With A Real Estate Agent, You Can

According to the U.S. Bureau of Labor Statistics, the top 10% of real estate representatives made over $178,000 in 2019. The Balance likewise writes that "rock star" representatives doing countless dollars in deals each year are probably millionaires themselves based on commission rates. Real estate agents do lower their commission depending upon financial trends.

Nevertheless, it's essential to keep in mind that these are patterns on a grand scale. On a personal level, real estate agents as much less likely to decrease their rates for individual clients. According to 2019 information from the Customer Federation of America, 73% of realtors mentioned they would not decrease their basic commission rate.

This implies that the rate is determined using the home value before taxes and other charges are subtracted from the overall amount. As soon as you're finished taking a look at the realty commission calculator, head over to our cap rate calculator to discover this essential home valuing metric. And, make certain to visit our rental application and renter screening pages to find out more about these user friendly, fully online tools.

Picture by Volkan Olmez on UnsplashOne of the most regular discussions we have with homebuyers at Open Listings is about our 50% commission refund and how genuine estate agent charges work. Time and time once again, we're asked by buyers to expose this homebuying myth: Numerous real estate agents will inform homebuyers that their service is free, and that as a purchaser, there's no cost.

Let's take a moment to break it all down: As a buyer, your agent and the seller's representative divided a commission cost generally 56% of the purchase price of the house. And while this charge is technically paid by the seller, it's factored in to how much sellers note their house for.

Here's what truthful real estate representatives had to state in articles on Realtor. com, HGTV, and The Balance about who pays agent commissions:" Requirement practice is that the seller pays the realty commission of both the listing representative and the purchaser's agent, according to Ruth Johnson, a Real Estate Agent in Austin, TX.

The Only Guide to How Much Is The Commission Of A Real Estate Agent

com "Who Pays The Realty Representative When You Purchase A House?"" Sellers consider the cost of commissions when they price their homes. Usually, the listing agent and the buyer's agent divided the commission from the deal. says Jay Reifert of the Excel Exclusive Purchaser's Agency in Madison, Wis. 'But you are the only one bringing money to the closing table.'" Source: HGTV.com "Discover The Pros & Cons of A Buyer's Representative"" Why? Due to the fact that it's typically part of the sales rate.

About

Don't forget to inspect Craigslist, either - I've been shocked by residential or commercial properties that turn up on there from time to time. Tagged: how to find commercial real estate deals, how to find business genuine estate, how to find industrial property financial investments, business property financial investments, investing in industrial realty, discovering business realty, methods to discover business properties.

Over the past year and a half, I've grown a property portfolio from 0 to 22 units, part time, without a large preliminary financial investment. The majority of our growth has actually originated from a few great deals that had exits or a chance to re-finance and pull our equity out. Put simply, my technique counts on purchasing good deals that supply the chance for rapid growth.

Even though I purchase a cashflow friendly market in St. Louis, excellent deals are tough to come by on the MLS. It's a sellers market, and numerous sellers are checking their luck with high listing prices (myself included!). This suggests that as a buyer, discovering offers is hard, and we need to do whatever we can to source quality offers.

So, how do you build a system to reliably source quality financial investment opportunities without working full time? There are lots of techniques I use, but at its core, the secret is building excellent relationships in your market, and leveraging those Visit this website relationships into offers. The typical financier trying to construct a portfolio looks for a deal the incorrect method.

Joe finds a residential or commercial property that he has an interest in on the MLS, and runs a bit of diligence. Then Joe calls their agent, or the listing representative to make an offer at a price that would justify a bargain. The seller declines their deal, and Joe leaves frustrating, convinced that the deal is dead, and the marketplace is too hot.

About How To Become A Real Estate timeshare weeks Developer

While this might be an oversimplification, many investors aren't ready or don't understand the value of going a level deeper in an effort to learn details that might turn the home into an excellent deal, or to uncover another deal that hasn't hit the marketplace yet. If I was looking at the exact same deal on the MLS, my procedure would be extremely different.

Depending upon what the listing representative states about the condition of the home, I will have a great idea of what I want to pay. Now that I have my numbers and questions, I'm all set to call the listing agent. Usually, I like to introduce myself, and give a quick background of what I do so the other representative understands I'm not going to lose their time.

I'm an investor that concentrates on multifamily with a worth include element comparable to your listing at 123 Elm Street - how to get a real estate license in ohio. Do you have a couple of minutes to talk?" Now that I've presented myself, I will typically ask particular concerns about the age and condition of the plumbing, roofing, electrical A/C, and present tenants.

If my offer is substantially lower than sale price, I usually preface the offer acknowledging that I comprehend that they have listed at a fair price, but I purchase utilizing a particular financial model, and this is where I'm able to offer. I ensure that absolutely nothing is individual, and I'm not assaulting either the representative or the sellers price (what is the difference between a real estate agent and a broker).

Generally I simply ask the agent to float the deal to the seller, and if it makes sense, I'll put it on paper. Now is where things get interesting. No matter the result of this deal, I have actually just invested around 10 minutes talking about property with a representative that is active in the area I like to buy, and if I have actually done my job right, they are now confident I can close any offers that satisfy my criteria.

3 Simple Techniques For What Is A Cma In Real Estate

An excellent example of my buy box would be "4100 system houses with a worth add component in cash-flow to fringe communities. I can close anything under 20 units myself, and have actually investors already signed on for anything bigger." This provides the other agent a clear idea of what I'm looking for, and how I'm going to be able to close.

Generally the response is no, but it's relatively common for the representative to point out some of their other clients that do have residential or commercial property they're thinking of offering that might meet the criteria. Guess who just made it to the top of the list for a prospective off-market deal?Another great method to find deals is through networking with other property experts.

Every day I see 510 off market deals published I can examine. I have actually yet to purchase an offer from Facebook, but I have actually made a couple rent timeshare uses, and it's just a matter of time. Another excellent opportunity for finding offers is through your residential or commercial property supervisor (if you have one). Your home supervisor spends their whole day dealing with hundreds of residential or commercial properties and investors, so it's a respectable bet they know when someone is likely to sell.

If you haven't already, give your property supervisor a call and let them understand your purchasing requirements. After all, if they find a good deal for you, they will practically certainly get to manage the residential or commercial property after you close. It's a true win win for both celebrations. The last deal I purchased was sourced by my property supervisor, and they often send me off-market deals to consider.

Some of your buddies may get a bit fed up with hearing about it, but you much better think when anyone they know has a real estate concern, they're going to funnel them to you. It might not turn into an offer today, but you never understand where a connection may lead.

Some Of How To Become A Real Estate Agent In Ga

While you might not have the whole story, it's a quite sure thing to believe that whoever is remodeling the house understands how to discover a deal (or at least they believe they can!). A Rehabilitation In ProgressIf I ever drive/walk by a dumpster and see a crew working, I'll always ask if the owner is there, and see if they have time to discuss investing.

I won't go in depth on the very best way to do direct-mail advertising in this post, but it does work. However, it can be really capital extensive, and it takes duplicated mailers to have a lot of success. I'm not presently pursuing this method as I'm too hectic with my start-up, and it needs you to be consistently available to address the phone when a seller calls. what is escheat in real estate.

I won't lie to you. Finding an offer in this market isn't easy, no matter what you do. If it was simple, everybody would be an effective financier. What I can inform you, is that discovering a deal isn't rocket science. It's a problem you can approach methodically, and the effort you put in will pay dividends if you're relentless.